The 15-Second Trick For Pacific Prime

Table of ContentsThe Best Strategy To Use For Pacific Prime8 Easy Facts About Pacific Prime ExplainedSee This Report about Pacific PrimeThe smart Trick of Pacific Prime That Nobody is DiscussingOur Pacific Prime Statements

Your agent is an insurance policy professional with the knowledge to lead you through the insurance coverage process and assist you find the finest insurance security for you and the people and points you respect most. This post is for informative and recommendation objectives only. If the plan coverage summaries in this article conflict with the language in the plan, the language in the plan applies.

Policyholder's fatalities can also be contingencies, particularly when they are considered to be a wrongful fatality, along with residential property damages and/or devastation. Due to the unpredictability of claimed losses, they are labeled as backups. The guaranteed person or life pays a premium in order to obtain the benefits assured by the insurance company.

Your home insurance policy can assist you cover the problems to your home and manage the price of restoring or fixings. Occasionally, you can additionally have protection for products or prized possessions in your house, which you can then purchase replacements for with the money the insurance policy firm offers you. In case of an unfavorable or wrongful fatality of a single earner, a family's financial loss can possibly be covered by specific insurance policy strategies.

What Does Pacific Prime Do?

There are numerous insurance policy prepares that consist of financial savings and/or financial investment schemes in addition to normal protection. These can aid with building savings and riches for future generations using regular or repeating investments. Insurance can assist your family members keep their criterion of living in the occasion that you are not there in the future.

The most fundamental form for this kind of insurance policy, life insurance policy, is term insurance. Life insurance policy in basic aids your family members end up being protected economically with a payout amount that is provided in the event of your, or the plan owner's, death throughout a details plan duration. Youngster Strategies This kind of insurance policy is primarily a cost savings instrument that aids with creating funds when children reach particular ages for seeking college.

Home Insurance This kind of insurance policy covers home problems in the occurrences of mishaps, natural tragedies, and problems, together with other similar events. global health insurance. If you are seeking to seek settlement for accidents that have occurred and you are struggling to identify the correct path for you, reach out to us at Duffy & Duffy Legislation Company

The Definitive Guide for Pacific Prime

At our law practice, we recognize that you are undergoing a great deal, and we comprehend that if you are concerning us that you have been with a lot. https://www.mixcloud.com/pacificpr1me/. As a result of that, we provide you a totally free appointment to discuss your issues and see just how we can best aid you

Due to the fact that of the COVID pandemic, court systems have been closed, which adversely influences car accident instances in a remarkable method. Once more, we are below to help you! We proudly serve the individuals of Suffolk Area and Nassau Area.

An insurance plan is a lawful contract between the insurance policy firm (the insurance provider) and the person(s), business, or entity being guaranteed (the insured). Reviewing your plan aids you validate that the policy meets your demands and that you recognize your and the insurance provider's duties if a loss takes place. Numerous insureds buy a policy without understanding what is covered, the exclusions that remove protection, and the problems that have to be fulfilled in order for coverage to apply when a loss happens.

It identifies that is the insured, what dangers or property are covered, the policy limitations, and the policy period (i.e. time the plan is in force). The Declarations Web page of a life insurance plan will consist of the name of the person insured and the face amount of the life insurance plan (e.g.

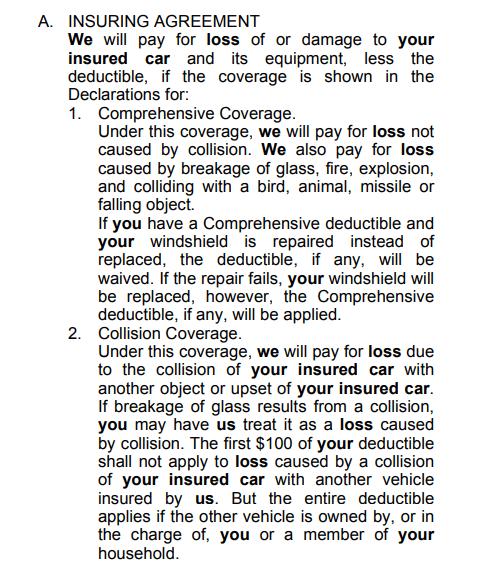

This is a recap of the major promises of the insurance coverage company and states what is covered.

Pacific Prime - Questions

Allrisk insurance coverage, under which all losses are covered other than those losses particularly omitted. If the loss is not omitted, then it is covered. Life insurance click resources policy plans are usually all-risk plans. Exemptions take coverage far from the Insuring Agreement. The three significant sorts of Exclusions are: Omitted risks or reasons for lossExcluded lossesExcluded propertyTypical examples of excluded risks under a property owners plan are.